Welcome to the Vesta User Guide!

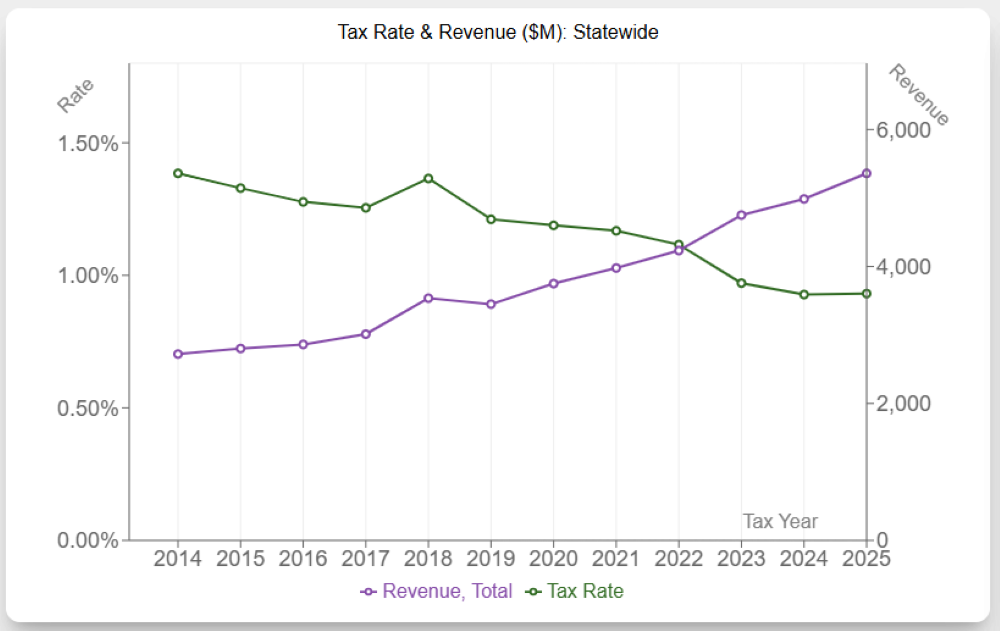

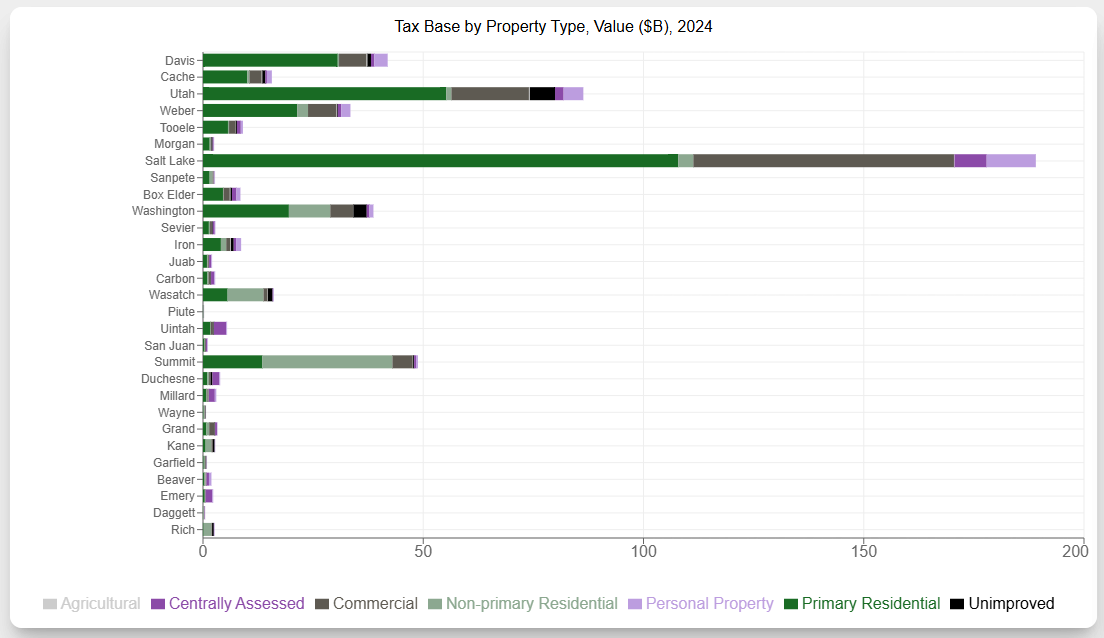

Vesta is an interactive web application developed by the Office of the Legislative Fiscal Analyst and designed to provide insight into the Utah state property tax system. It primarily draws on the data managed and overseen by the Property Tax Division of the State Tax Commission. The data itself can be accessed on the Commission’s certified rate site found here.

Unlike sales or income tax, the state of Utah does not directly levy a statewide property tax. Instead, property taxes are primarily levied at the county and local levels. Despite this, since the taxing authority of these political subdivisions ultimately derives from the state, having empirical insight into how the system functions is useful for residents, taxpayers, and policymakers at all levels. Providing this insight in a convenient, user-friendly, and digestible form is the central aim of Vesta.

In order to provide a useful perspective on property taxes, Vesta is organized into pages built around groups of related questions. These pages (Home, Entity Profiles, Statewide Comparison, Analysis, & Glossary) can be accessed from anywhere in the app from the navigation bar at the top of the screen. See the tutorials below for additional page-specific information.